On May 8, 2020, the Governmental Accounting Standards Board (GASB) issued Statement No. 95, Postponement of the Effective Dates of Certain Authoritative Guidance, to provide temporary relief to state and local governments in light of the COVID-19 pandemic.

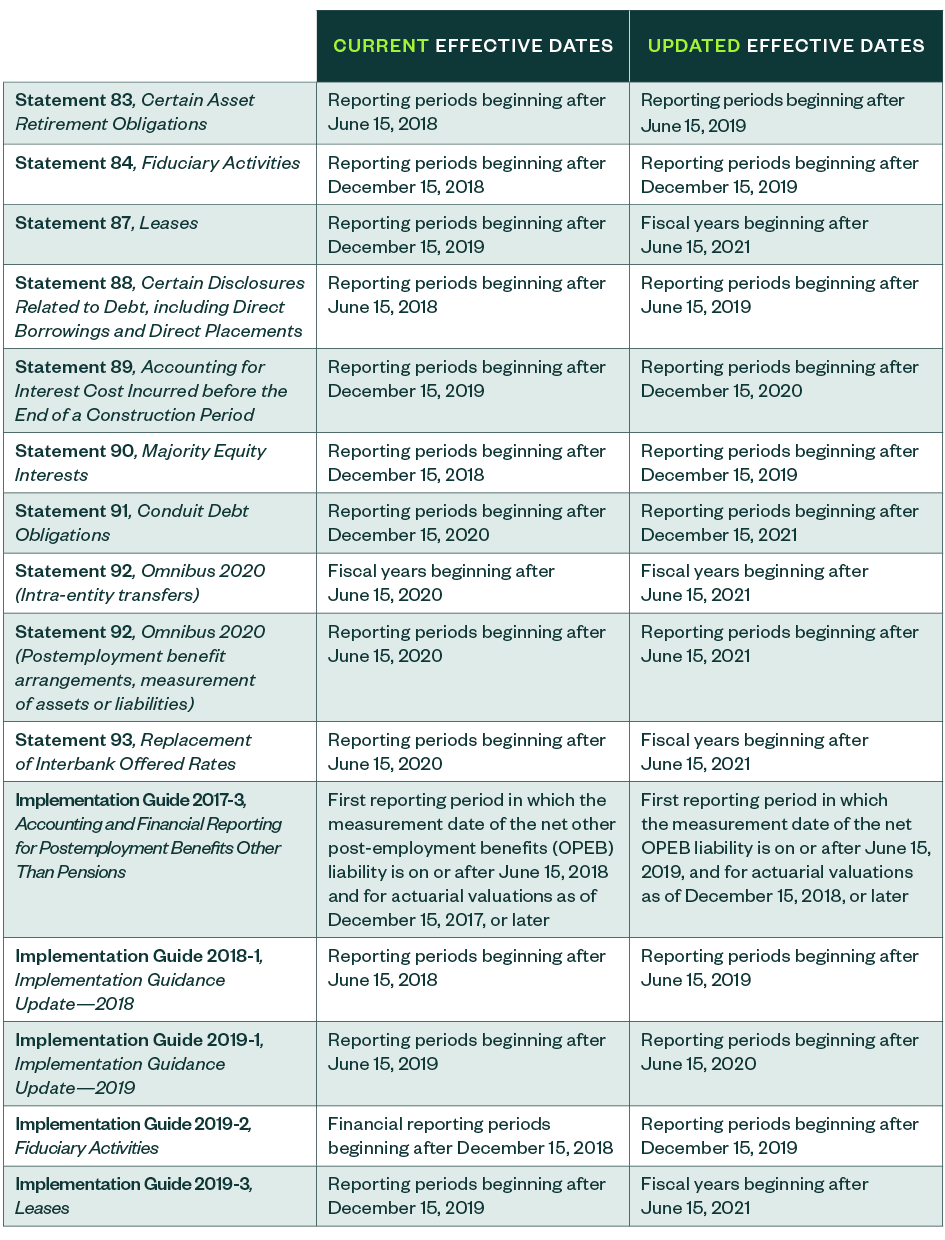

The statement defers the effective dates of Statement No. 87, Leases, and Implementation Guide No. 2019-3, Leases, by 18 months. The statement also defers the effective dates of certain other statements and implementation guides by one year—as detailed in the below table.

The provisions of Statement No. 95 are effective immediately.

Key Provisions

The GASB initiated its project to postpone the effective dates of certain statements and implementation guides as a result of the closure of many state and local government offices due to the COVID-19 pandemic. As a result of such closings, many government officials don’t have access to the information necessary for implementing new GASB pronouncements.

Effective Dates

The updated effective dates are as follows.

Early application of the amended provisions is still permitted to the extent specified in each pronouncement as originally issued.

We’re Here to Help

For more information on how the deferred effective dates could affect your organization, contact your Moss Adams professional.